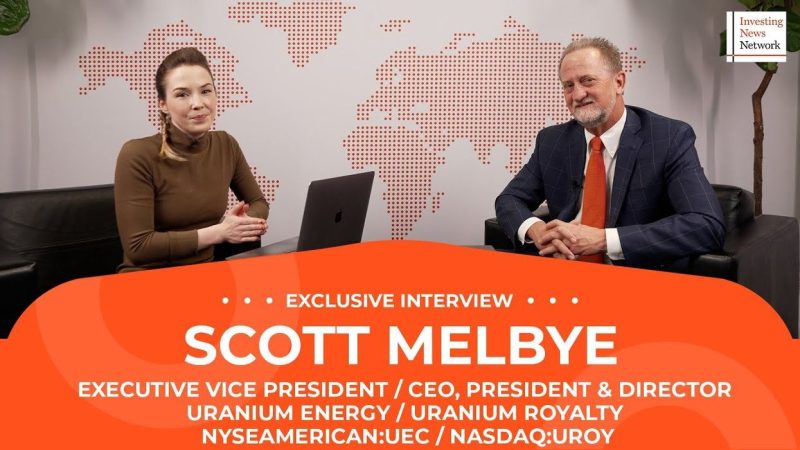

Scott Melbye discussed the uranium market, as well as plans for Uranium Energy (NYSEAMERICAN:UEC) and Uranium Royalty (NASDAQ:UROY) as prices and sentiment for the energy commodity continue to heat up.

In his view, the uranium story is nothing like that of lithium, whose price has fallen significantly after running up.

‘The fundamentals behind uranium supply and demand — the demand for nuclear power, which is driving the need for uranium and new mine production — couldn’t be more different than where lithium is today,’ Melbye said. ‘We’re still very much in the first or second inning of what is going to be a historic bull market.’

With that backdrop in mind, Uranium Energy confirmed in January that it will be restarting production at its Wyoming-based Christensen Ranch in-situ recovery operation and Irigaray processing plant, with first output expected in August. Melbye said that the Burke Hollow in-situ recovery project in Texas will be next in line.

Uranium Energy’s production is currently 100 percent unhedged, which he explained isn’t common among miners. The strategy is designed to give investors full exposure to the uranium spot price.

When asked about where uranium prices could go, Melbye said there’s scope for them to run higher.

‘There’s nothing to keep uranium from going to US$150, US$200 a pound in this environment,’ he said on the sidelines of the Prospectors & Developers Association of Canada (PDAC) convention.

‘Now, is that the long-term equilibrium price for uranium? No. But we’ve never been at that magical theoretical cross in the graph where those things intersect — we’re either way below or way above. But I think even when the price pulls back to more of a long-term clearing price it’s not US$50, US$60 like we saw in the past … inflation and CAPEX are real issues. So I think it’ll be several years before we get the production needed to really moderate this.’

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.