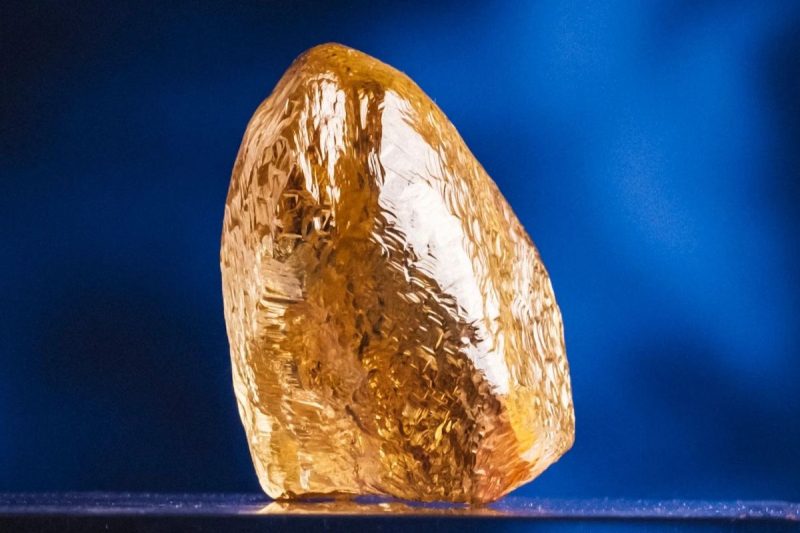

In a discovery that offers a glimmer of optimism amid a turbulent year for the diamond industry, Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) has unveiled a 158.2 carat yellow diamond from its Diavik diamond mine, located in the remote Northwest Territories (NWT).

The rough gem, described by Rio Tinto as a “miracle of nature,” is one of only five yellow diamonds exceeding 100 carats ever recovered from Diavik since it began operations in 2003.

The diamond, unearthed from one of the most challenging mining environments on Earth, underscores Diavik’s reputation for producing rare and high-quality stones.

While the mine is best known for its white gem-quality diamonds, less than one percent of its output consists of yellow diamonds, making this latest find a significant event in the mine’s 22 year history.

“This two billion year old, natural Canadian diamond is a miracle of nature and testament to the skill and fortitude of all the men and women who work in Diavik’s challenging sub-Arctic environment,” said Matt Breen, COO of Diavik Diamond Mines, in a press release.

The Diavik mine, jointly operated by Rio Tinto and located entirely off the grid, has also become a model for sustainable mining in the Arctic. It has integrated renewable energy sources into its operations, including a wind-diesel hybrid facility introduced in 2012 and a solar power plant completed in 2024.

This commitment to sustainability adds further value to its diamonds, which carry a provenance often sought by ethical consumers and collectors alike.

This is not the first time Diavik has made headlines with extraordinary finds. In 2018, the mine unearthed a 552 carat yellow gem-quality diamond — the largest ever found in North America.

Known as the ‘Canadamark’ yellow diamond, the discovery eclipsed the previous record set by the 187.7 carat Diavik Foxfire diamond, found in 2015.

Portions of the Foxfire were later cut into two brilliant-cut pear-shaped diamonds, which sold at a Christie’s auction for US$1.3 million.

But while such discoveries reinforce Diavik’s status as a producer of rare gems, they also arrive during a precarious moment for the broader NWT mining sector.

The territory’s three major diamond mines — Diavik, Ekati, and Gahcho Kué — are grappling with steep financial losses, with Diavik alone reporting a US$127 million loss in 2024. These financial headwinds stem from a combination of inflationary pressures, weakened global diamond prices, and unexpected disruptions, including a tragic plane crash near Fort Smith early last year.

Industry advocates are now urging the territorial government to step in and provide relief, particularly in the form of easing property tax burdens.

Blue diamond steals spotlight in US$100 million Sotheby’s exhibit in Abu Dhabi

On the international front, a 10 carat rare blue diamond from South Africa has emerged as the crown jewel of Sotheby’s latest diamond exhibition in Abu Dhabi.

Part of an eight stone showcase valued at over US$100 million, the blue diamond is expected to fetch around US$20 million when it goes to auction in May.

Sotheby’s selected the UAE capital for the exhibit due to the region’s increasing appetite for high-end diamonds. “We have great optimism about the region,” said Quig Bruning, the company’s head of jewels in North America, Europe, and the Middle East.

“We feel very strongly that this is the kind of place where you have both traders and collectors of diamonds of this importance and of this rarity.”

Petra Diamonds delays Cullinan tender as US tariff shockwaves hit market

Meanwhile, Petra Diamonds (LSE:PDL,OTCPink:PDLMF) announced last week that it would delay the sale of gems from its Cullinan mine due to uncertainty over new US tariffs on imports — including diamonds.

The delay comes amid heightened concerns that the tariffs, introduced last week, could disrupt global diamond flows and further depress an already sluggish market.

Petra had already sold 176,000 carats from its Finsch and Williamson mines for US$18 million in its fifth tender of the year — a modest 9 percent price increase over the previous round.

However, overall tender revenue is down 25 percent year-on-year, totaling $103 million so far in 2025, compared to US$138 million during the same period in 2024. Shares of Petra fell 6.1 percent following the announcement.

The Cullinan Mine, famously the source of the largest gem-quality diamond ever discovered, has recently struggled to yield high-quality stones, further complicating Petra’s recovery efforts amid market volatility and its ongoing restructuring plan.

The diamond market isn’t the only luxury segment to be impacted by geopolitical trade tensions.

On April 10, Prada Group (HKEX:1913) which owns luxury brand Prada, announced its acquisition of the Versace brand from Capri Holdings (NYSE:CPRI) for US$1.38 billion, marking a significant consolidation in the luxury fashion industry.

The deal reunites two iconic Italian brands and positions Prada to better compete with industry leaders like LVMH (OTC Pink:LVMHF,EPA:MC) and Kering (EPA:SSKEG). Capri Holdings, which acquired Versace for US$2.1 billion in 2018, faced challenges with the brand’s performance, including a 15 percent decline in revenue in late 2024. The sale allows Capri to refocus on its core brand, Michael Kors, and address financial pressures following a blocked merger with Tapestry (NYSE:TPR) in 2023.

According to a January report from McKinsey, The luxury goods sector faces a challenging outlook in 2025, with global growth projected to slow to between 1 percent and 3 percent annually through 2027.

This deceleration follows a period where price increases accounted for over 80 percent of growth from 2019 to 2023, a strategy that has now reached its limit as aspirational consumers become more price sensitive.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.